CTC stands for Cost to Company. It is the total amount a company spends on you in a year. This includes not just your basic salary but also benefits, bonuses, allowances, and other costs. It is important to know that your CTC is not the same as your take-home salary. Understanding it helps you see the full value of your job package and plan your finances better.

Components of CTC

A typical CTC is made up of several parts:

- Basic Salary

This is the fixed part of your salary and forms the base for many other components like PF and HRA. - House Rent Allowance (HRA)

If you live in a rented home you get this allowance which is partially tax-exempt. - Conveyance Allowance

Covers your daily travel to and from work. - Special Allowances

These can include meals, mobile bills, or company-specific perks. - Bonus or Performance Incentives

This is usually annual or quarterly and may depend on your performance or company targets. - Provident Fund (Employer Contribution)

Normally 12% of your basic salary, this goes into your retirement fund but is counted in your CTC. - Gratuity

Applicable if you stay with a company for over five years. Usually about 4.81% of your basic salary. - ESIC (if applicable)

Employee State Insurance is added for employees with gross salary under ₹21,000.

Example of CTC vs Take-Home Salary

Imagine your CTC is ₹10,00,000 per year. A possible breakup could look like this:

| Component | Annual Value (₹) |

| Basic Salary | 3,00,000 |

| HRA | 1,20,000 |

| Special Allowance | 2,00,000 |

| Bonus | 1,00,000 |

| Employer PF | 36,000 |

| Gratuity | 14,430 |

| Mediclaim & Other Perks | 30,000 |

| Total CTC | 10,00,000 |

Estimated Take-Home Salary: ₹7.8L – ₹8.2L depending on taxes and PF deductions.

Example 1

Entry-level employee with smaller perks and bonuses.

Example 2

Senior employee with higher performance incentives and special allowances.

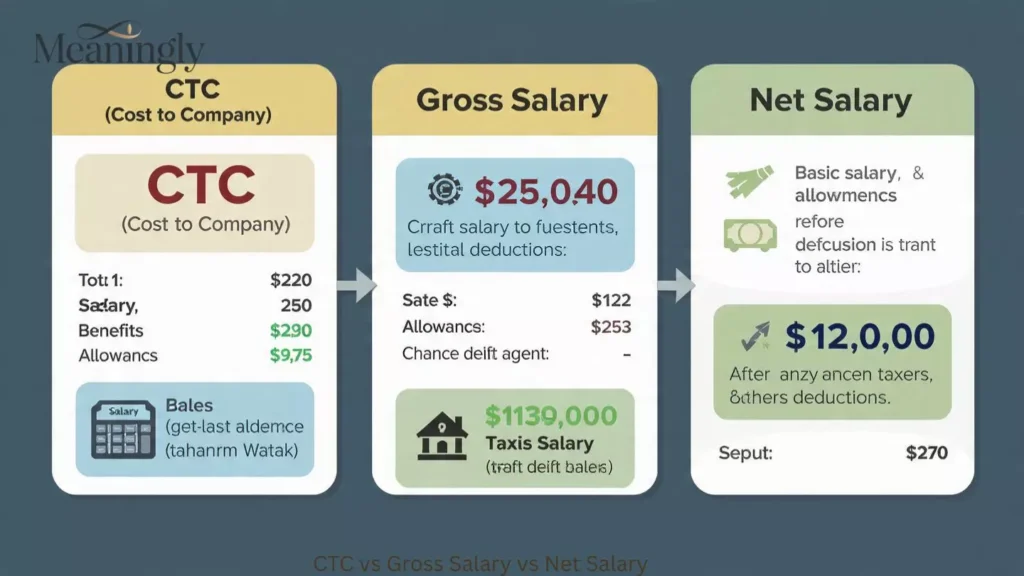

CTC vs Gross Salary vs Net Salary

- CTC is the total cost the employer pays for you including perks, bonuses, and contributions.

- Gross Salary is your CTC minus employer contributions like PF and gratuity.

- Net Salary or Take-Home is what you actually receive after all deductions.

Common Misconceptions About CTC

- High CTC always means high take-home – false

- CTC includes all conditional bonuses – clarify during negotiations

- Reimbursements are always part of CTC – only if specified

- CTC is the same as monthly salary – no, it is the total annual cost to the company

Why CTC Matters

- Helps HR plan total workforce expenses

- Helps employees understand real compensation

- Useful for comparing job offers, negotiating hikes, and planning finances

How to Negotiate a Better CTC

- Ask for a clear breakup of fixed and variable pay

- Consider taxable versus non-taxable components

- Check estimated take-home after deductions

- Include perks and benefits in your discussion

How to Calculate Your CTC

Calculating CTC is simple. It is the sum of all costs the company spends on you in a year.

Formula:

CTC = Fixed Salary + Variable Pay + Employer Contributions + Perks

Step by Step Calculation

- Add your basic salary

- Include HRA, conveyance, and special allowances

- Add bonuses and performance incentives

- Include employer contributions like PF and gratuity

- Add insurance or other perks

CTC & Take-Home Calculator

You can use this to estimate take-home salary:

- Basic Salary (₹):

- HRA (₹):

- Special Allowance (₹):

- Bonus (₹):

- Employer PF (₹):

- Gratuity (₹):

- Insurance (₹):

Calculate your take-home to see what you will actually get in hand.

CTC in Different Contexts

CTC in British English

Refers to the total employee compensation including salary, benefits, and pension contributions.

CTC in American English

Often called total compensation, including base pay, bonuses, stock options, and benefits.

Frequently Asked Questions

What is Cost to Company (CTC) and gross salary

CTC includes all benefits while gross salary is the income before deductions but does not include employer contributions to benefits.

How is Cost to Company (CTC) calculated

It is the sum of fixed salary, variable pay, employer contributions, and perks.

What does CTC include

Basic, HRA, allowances, bonuses, PF, gratuity, insurance, and other benefits.

Is CTC the same as take-home salary

No, take-home is after all deductions.

What is the difference between CTC and in-hand salary

CTC is total employer spending, in-hand is what you receive after deductions.

What are the Cost to Company Benefits in India

PF, gratuity, insurance, HRA, conveyance, and other allowances.

How to make the most of the CTC being offered

Negotiate components, focus on taxable vs non-taxable parts, and consider perks along with base pay.

Conclusion

CTC shows the total amount a company spends on you and gives a complete picture of your job value. Your take-home will be less than your CTC but knowing the breakdown helps you plan finances and negotiate effectively.

Anna Alesa is an experienced content writer with over 4 years of expertise in creating high-quality articles for meaning-based websites.